08/04/11

AKS,

CMC,

HSC, MT,

NUE,

PKX, RIO, SID,

STLD, TX, VALE &

WORAll things Steel or is Steel a Steal

12 Stocks in the Steel & Iron Industry

This analysis was performed after the close of the US markets on August 4, 2011.

Closing values were as follows:

S&P 500 1,200.07

VIX 31.66

The stocks below were chosen because they are all within the Steel & Iron Industry. Recent market turmoil has led to significant repricing in nearly all Sectors and Industry categories. This particular Industry was not chosen for any specific reason other than we happened to be research on the Industry at the time. Many of the companies shown are not domestic US and therefore may have issues related to dividend payments and yield.

Given the dramatic decline in prices, the options chosen were as close to spot as possible. Because the pricing is market close some options were avoided because the closing prices did not seem accurate.

Symbol Name

AKS AK Steel Holdings Corp - #3 rated in this group - #2 in

SSR and #4 in Days Earning - There is no

current P/E and

teh forward P/E is at 6.21 - The stock is at its 52 week low so the

RVI's are at the bottom.

CMC Commercial Metals Company - #1 rated in this group as well with

SSR and Days Earning -

RVI's are low and the Days Earning are 76 bps. The

SSR is over 11%. There is no current P/E however, the forward P/E is 7.8.

HSC Harsco Corporation - This is the least attractive stock of the group, ranked #13 of 12.

RVI's are mid to low, however, the

SSR and Days Earning are very low and in the current environment not attractive.

MT

Arcelor Mittal - This is a stock we have liked and owned. The stock is currently at its 52 week low so

RVI's are attractive. The next dividend is not until November so this is a pure

volatility play.

NUE Nuroc Corporation - This is a stock we have liked and owned. The stock is currently at its 52 week low so

RVI's are attractive. The next dividend is not until September and is currently estimated at 3.9%.

PKX POSCO Common Stock - One of the few stocks not at its absolute price low - There is no listed dividend so we will pass on

PKX.

RIO Rio

Tinto Plc -

RVI's are mid range thus the stock is not trading at its 52 week lows. The Sept analysis note is off as the Days earning w/o div is 0.46%/day. RIO is #11 of this group

and at $118 one of the largest cap stocks. This appears to be a more conservative play.

SID

Companhia Sidrurgica Nacional - #2 rated in this group - #3 in

SSR and #2 with Days Earning - it is tempting based on the analysis and overall trade earning profile.

STLD Steel Dynamics - Another stock at its price low. #5 overall in this group, however, the dividend treatment by the model is off therefore the near date

SSR is 3.62% and the mid date is 3.25%

TX

Ternium S.A. - #4 rated in this group - #4 in

SSR and #3 in Days Earning - , however, the dividend treatment by the model is off therefore the near date

SSR is 4.5% and the mid date is 9.8%. The stock is at its 52 week lows making the

RVI's attractive at the bottom of the range.

VALE VALE S.A. American Depository - #8 overall in the group and a stock we looked at last December. It is one of the large cap stocks of the group. The

RVI's are mid low and the overall profile is attractive.

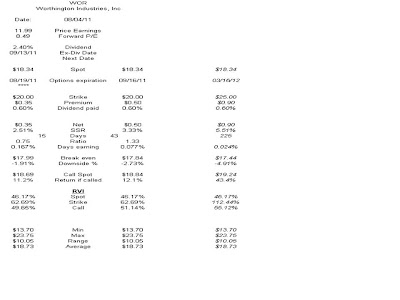

WOR Worthington Industries, Inc - #11 in the group and also having issues with the dividend calculation in our model. The near date

SSR is 1.9% while the mid date is 3.3% earning the dividend.

RVI's are mid.

*Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.