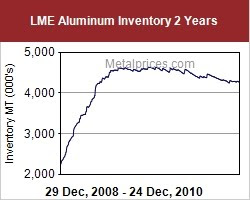

Looking at the pricing charts below from http://www.metalprices.com/ you will see why we have liked commodity and specifically metal (Basic Material sector) stocks. Metal as with nearly all commodity prices are on the rise. We know that commodity prices have unique characteristics. Supply and demand have a great impact on pricing as does inflation. Another impact that is often over looked is currency fluctuation. US Dollar weakness has had an impact on the domestic price of metals. However, I believe it is safe to say that without regard to the dollar exchange rate, worldwide prices of metals have risen. Future pricing is any body's guess, however, the stocks we show below offer tremendous statistical profiles and once you have investigated their fundamentals, I am sure you will be as impressed with them as we have been.

The following analysis was performed on 12/23/10 using closing market pricing.

The VIX was at 16.47 and the S&P 500 Index was at 1,256.77.

Symbol Name

FCX Freeport McMoRan - Phoenix, Arizona headquartered with operation is the Americas and Asia. #1 overall profile in this group. No secret we like this stock statistically and fundamentally.

RIO Rio Tinto Plc - UK headquartered company with operations on nearly every Continent. RVI's are high but the P/E's are excellent. We like their Balance Sheet but are frustrated with only annual data.

SCCO Southern Copper Corp - #3 overall statistical profile based on this group. Phoenix, AZ based company with operations in Mexico and South America. High RVI's and P/E with a good forward P/E. We really like their Balance Sheet.

VALE VALE S.A. American Depository - Brazil headquartered company. High RVI's, low P/E's. We like their balance sheet, unfortunately they only provide quarterly data.

X United States Steel Copr - Tied for #2 overall based on statistical profile - Domestic US headquartered company. RVI's are mid range, dividend is weak as are P/E's. We would suggest a strong fundamental review if you were considering a purchase.

*Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.

As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.

The VIX was at 16.47 and the S&P 500 Index was at 1,256.77.

Symbol Name

FCX Freeport McMoRan - Phoenix, Arizona headquartered with operation is the Americas and Asia. #1 overall profile in this group. No secret we like this stock statistically and fundamentally.

MT Arcelor Mittal - Luxembourg headquartered with worldwide operations - #3 overall profile in this group. RVI's are low as are P/E's. Unfortunately, we cannot get comfortable with the available financial data.

NEU NewMarket Corp - Richmond, Virgina headquartered with worldwide operations - Our analyst slipped in this company - still in the Basic Materials section but focused on chemicals. Never the less, RVI's are high but P/E's are low

PKX POSCO Common Stock - South Korea based Company - winds of war aside. RVI's and P/E's are attractive but the dividend is low. Overall, #8 on a list of attractive stocks. We like the fundamentals based on the available annual financial data.

RIO Rio Tinto Plc - UK headquartered company with operations on nearly every Continent. RVI's are high but the P/E's are excellent. We like their Balance Sheet but are frustrated with only annual data.

SCCO Southern Copper Corp - #3 overall statistical profile based on this group. Phoenix, AZ based company with operations in Mexico and South America. High RVI's and P/E with a good forward P/E. We really like their Balance Sheet.

VALE VALE S.A. American Depository - Brazil headquartered company. High RVI's, low P/E's. We like their balance sheet, unfortunately they only provide quarterly data.

X United States Steel Copr - Tied for #2 overall based on statistical profile - Domestic US headquartered company. RVI's are mid range, dividend is weak as are P/E's. We would suggest a strong fundamental review if you were considering a purchase.

*Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.

As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.

No comments:

Post a Comment