12/23/11 - POTASH - AGU, BG, IPI, MON & MOS

The following analysis was performed on 12/23/10 using closing market pricing.

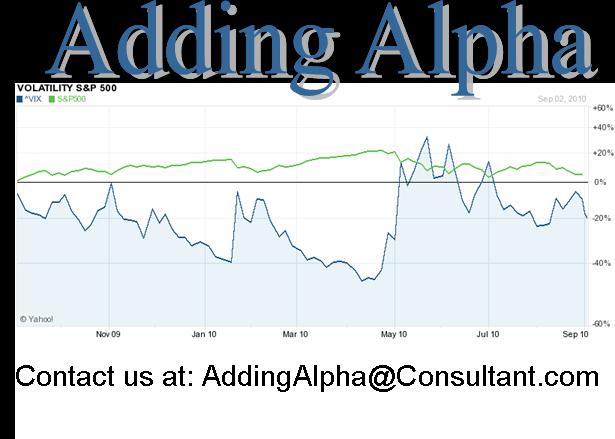

The VIX was at 16.47 and the S&P 500 Index was at 1,256.77.

We took a liking to Potash companies a while ago. Fortunately, it was before the industry began catching other investors attentions and stock prices were more reasonably priced. Prices are very attractive now, however, way way way back then stock prices seemed too cheap. Spot prices are still mixed and we believe value remains. Not all these companies are pure fertilizer/potash plays and they are slpit in terms of capitalization with MON leading at $35.7 billion and BG trailing at $2.7 billion. Interestingly these two stocks have the lowest RVI's of the group. Although we cast our lot with MOS and MON, the others represent value and we leave to you to decide which you like best.

Definition of Potash: a potassium compound often used in agriculture and industry

Potash on wiseGEEK: Chemically,

potash consists of potassium carbonate, but also might contain potassium oxide or potassium chloride, depending on how pure you consider the mixture.

Boiling hardwood ash in water creates runoff that can be processed to form either lye or potash. Potash contains high amounts of essential plant nutrients; therefore it is mostly used as an agricultural fertilizer. With a long history of mining and manufacturing, the potassium salts help form soap, glass, and dyes.

Chemically, potash consists of potassium carbonate, but also might contain potassium oxide or potassium chloride, depending on how pure you consider the mixture. Usually, potash takes the form of powdery salts. Modern methods of extraction almost all rely upon deposits mined from ores, like sylvanite.

Historically, the manufacture and trade of potash traces an interesting period in the New World's economy. As one of the largest cash crops of the late 1700s and early 1800s, potash established strong trade routes through upstate New York, Canadian provinces, and overseas to Russia and England. At a time when land covered in hardwood forests was more valuable as farmland, settlers felled hundreds of thousands of acres of trees. Not only did this create lumber for building, but also they found a way to extract even more money by creating potash.

The word potash is a compound of "pot" and "ash," showing how the salts were first made. All leftover tree material, including damaged branches and roots, were burned on a dry day. The most popular wood came from broadleaved trees, namely Elm.

When these ashes were soaked in hot water for a while, then filtered, the rudimentary stage of potash created lye. If this lye, filling huge pots in a kiln, was baked down to evaporate all the water, "black ash" resulted. Black ash was like an unfiltered kind of potash. Farmers could make far more money trading potash than either lumber or food crops.

Nowadays, our potash comes from mining and goes toward inorganic fertilizer rich in potassium. In fact, the widespread use of these kinds of fertilizers on major crops like corn, wheat, and vegetables means arable land yields more edible food per acre. Potassium protects plants against disease and pests, allows them to flexibly adjust to changing weather conditions, and encourages them to absorb more nutrients. The resulting crops are larger and more nutritious.

TICKER Stock

AGU Agrium, Inc - Pays in January therefore every scenario includes the dividend. RVI's are high as is the P/E.

-

BG Bunge Limited - More than just a fun stock name to say, we have been active in Bunge for quite a while. Mid value RVI's and extremely low P/E's. If you buy the stock it is also a lot a fun to talk about especially at the end of cocktail parties.

IPI Intrepid Potash, Inc - P/E's are high even using the forward rate. RVI's are high as well. The Days are exceptional and this is the overall stock based on the metric's.

Mon Monsanto Company - RVI's are mid range, and each scenario gets the dividend and P/E's are high. This is the highest capitalized stock of the group at $35.7 billion. This was one of our personal favorites.

MOS Mosaic Company - the #2 stocks on metrics, each earns the dividend and the RVI's are fair. One of our favorites, the SSR's are attractive. This is the second highest capitalized stock of the group at $31.7 billion.

*Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.

As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.