07/08/11 ADM, AGU, BG, CAG, CAT, CF, CPO, DE, GIS, HNZ, HRL, IPI, K, KFT, MON, MOS, POT, SLE, SMG & UAN

The initial stock list was generated by Todd Johnson in his Seeking Alpha article of July 8, 2011, entitled Building an Agriculture Income Portfolio. His stock list in included in ours and consists of AGU, CF, MOS, POT, TNH and UAN. We could not include TNH because there is no options market for the stock.

As you will notice we expanded on his list by including the Industry's of Fram Products, Agricultural Chemicals, Processed & Packaged Goods, Farm & Constrution Machinery and Food - Major Diversified. The stocks for the additional Industry classes were drawn from our existing database.

Overall, we like the farm and food sectors. Given the inflationary pressures in the economy and increasing demand for their products these sectors should perform well on an absolute and relative basis.

This analysis was performed at the market close of July 8, 2011.

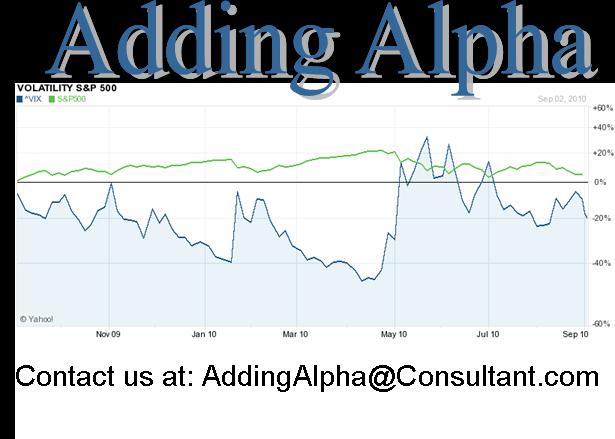

The VIX closed at 15.95.

The S&P 500 closed at 1,343.80.

Ticker Stock Name Commentary

ADM - Archer-Daniels-Midland Company -#2 overall in this group. We have liked ADM for a while. RVI's are mid, dividend is ok, and P/E's are very low.

AGU - Agrium, Inc - #5 in the group overall. RVI's are high and the dividend is low. We last looked at AGU in December. We struggle with this stock for unknown reasons and look for compelling reasons to buy it. Overall, we seem to prefer the other members of its sector.

BG - Bunge Limited -

CAG - ConAgra Foods, Inc -

CAT - Caterpillar Inc. -

CF - CF Industries Holdings, Inc - # 1 overall in the group, with a Days Earning of 24 bps. The dividend is low at 0.30%, the RVI's are high but the P/E's are good and each scenerio earns the dividend.

CPO - Corn Products International Inc. -

DE - Deere & Company -

GIS - General Mills, Inc -

HNZ - H.J. Heinz Company -

HRL - Hormel Foods Corporation -#4 in the overall group. RVI's are at the extremes and the dividend is low. The later dates earn the dividend. P/E's are a bid high and the valuations are at the high end. We would stick close to near dates.

IPI - Intrepid Potash, Inc -

K - Kellogg Company -

KFT - Kraft Foods Inc. -

MON - Monsanto Company -

MOS - Mosaic Company -

POT - Potash Corporation of Saskatchewan, Inc - #3 overall in this group. RVI's are high and the dividend is low. We like this sector and had been active in it previously, when it was the subject of merger mania. We made money and despite the lowe dividends have kept an interest in it.

SLE - Sara Lee Corp -

SMG - The Scotts Miracle-Gro Company -

UAN - CVR Partners, LP Common Units r -

*Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.