AA, ADM, AEP, AFL, AOS,APL, ATO, ATR, AVP, AWK, AZN, BA, BG, BHP, BKH, BMI, BMS, BOH, BPL, BWP, CAT, CCE, CHK, CINF, CL, CMC, CMS, CNP, COL, COP, CSL, CTAS, CVX, D, DBD, DCI, DD, DE, DOV, DUK, ED, EMR, EPB, EPD, ETN, ETR, EXC, FAST, FCX, FE, FII, GE, GLW, GWW, HAS, HCN, HEP, HON, HRL, HSC, HSH, IBM, INTC, JNJ, K, KLAC, KMP, LINE, LLY, LMT, LO, MCD, MCHP, MHP, MMM, MSA, MXIM, NEE, NS, NVS, OLN, PAA, PAYX, PBI, PEP, PFE, PH, PM, POT, PPG, PRE, QCOM, R, RES, ROL, RRD, SE, SMG, SO, SON, STM, STRA, TAP, TEG, TX, TYC, UMBF, UTX, X & XOM

This list is way too big, 110 stocks in total, to comment on each individual stock. We have highlighted the stocks we traded in today. All but two of these stocks were new to our portfolio. We allowed our equity position to decline to 30% keeping fixed income and money markets at 70% for year end. Preliminary numbers for the year look to be as expected, between fixed income and equities. Thus we have once again achieved our income and management goals.

For the most part we kept the positions added today smaller than usual. There remains much market uncertainty due to a number of factors. One specific factor is earnings fears. Our goal was to keep with energy/utility, commodity, Industrial (parts and machinery), agriculture and consumer staple companies.

Our process involved reducing the total list based on eliminating out liners that had poor liquidity, P/E's that could not be justified, high RVI's and low SSR's or Day's earnings. The reduced list is then compared to current holdings to eliminate current positions. Next we review the stock one name at a time and evaluate each stock on a fundamental and technical basis. Finally, we vote buy or pass.

Symbol Name

AA Alcoa Inc

ADM Archer-Daniels-Midland Company

AEP American Electric Power

AFL AFLAC Incorporated Common

AOS A.O. Smith

APL Atlas Pipeline Partners LP

ATO Atmos Energy Corporation

ATR AptarGroup, Inc

AVP Avon Products, Inc

AWK American Water Works Company, Inc.

AZN AstraZenica PLC

BA Boeing Company

BG Bunge Limited

BHP BHP Biliton Limited

BKH Black Hills Corporation

BMI Badger Meter, Inc

BMS Bemis Company, Inc

BOH Bank of Hawaii Coproration

BPL Buckeye Partners L.P.

BWP Boardwalk Pipeline Partners LP

CAT Caterpillar Inc.

CCE Coca-Cola Enterprises Inc

CHK Chesapeake Energy Corp

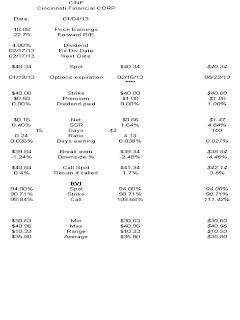

CINF Cincinnati Financial CORP

CL Colgate-Palmolive Company

CMC Commercial Metals Company

CMS CMS Energy

CNP CenterPoint Energy Inc

COL Rockwell Collins, Inc

COP ConocoPhillips

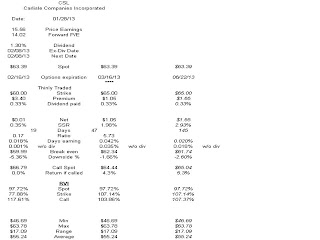

CSL Carlisle Companies Incorporated

CTAS Cintas Corporation

CVX Chevron Corp.

D Dominion Resources, Inc

DBD Diebold, Inc

DCI Donaldson Company, Inc.

DD E.I. Du Pont de Nemours

DE Deere & Company

DOV Dover Corporation common Stock

DUK Duke Energy

ED Consolidated Edison, Inc

EMR Emerson Electric Co.

EPB El Paso Pipeline Partners, LP

EPD Enterprise Products Partners LP

ETN Eaton Corporation

ETR Entergy Corporation

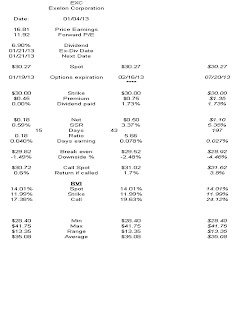

EXC Exelon Corporation

FAST Fastenal

FCX Freeport McMoRan

FE FirstEnergy Corp

FII Federated Investors, Inc

GE General Electric

GLW Corning Incorporated

GWW W.W. Granger, Inc.

HAS Hasbro, Inc

HCN Health Care REIT Inc

HEP Holly Energy Partners, LP

HON Honeywell

HRL Hormel Foods Corporation

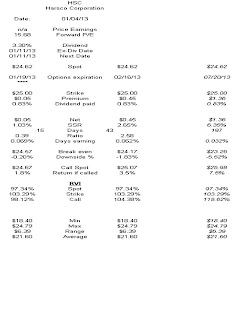

HSC Harsco Corporation

HSH Hillshire Brands (SLE)

IBM International Business Machines

INTC Intel Corporation

JNJ Johnson & Johnson

K Kellogg Company

KLAC KLA-Tencor Corporation

KMP Kinder Morgan Pipeline

LINE Linn Energy, LLC

LLY Eli Lilly and Co

LMT Lockheed Martin Corporation

LO Lorillard Inc

MCD McDonald's Corp

MCHP Microchip Technology Inc.

MHP The McGraw-Hill Companies, Inc.

MMM 3M Company

MSA Mine Safety Appliances Company

MXIM Maxim Integrated Products Inc.

NEE NextEra Energy Inc

NS Nustar Energy Lp

NVS Novartis AG

OLN Olin Corp

PAA Plains All American Pipeline, L.P.

PAYX Paychex, Inc.

PBI Pitney Bowes Inc

PEP Pepsico, Inc

PFE Pfizer, Inc

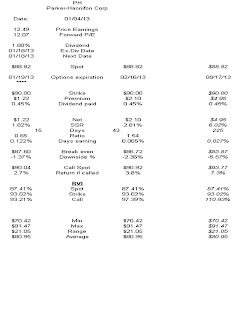

PH Parker-Hannifon Corp

PM Phillip Morris

POT Potash Corporation of Saskatchewan, Inc

PPG PPG Industries, Inc

PRE PartnerRe Ltd

QCOM Qualcomm Inc

R Ryder Systems, Inc

RES RPC, Inc

ROL Rollins, Inc

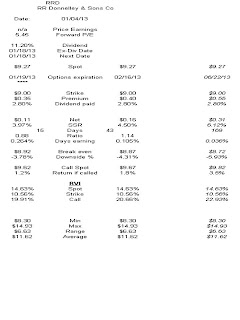

RRD RR Donnelley & Sons Co

SE Spectrs Energy Corp

SMG The Scotts Miracle-Gro Company

SO The Southern Company

SON Sonoco Products Co.

STM STMicroelectronics N.V.

STRA Strayer Education, Inc

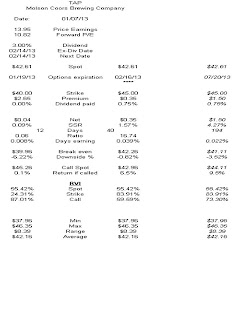

TAP Molson Coors Brewing Company

TEG Integrys Energy Group, Inc

TX Ternium S.A.

TYC Tyco International Ltd.

UMBF UMB Financial Corporation

UTX United Technologies Corp

X United States Steel Copr

XOM Exxon Mobil Corp

A question and debate arose in today's committee meeting regarding which stocks on the list we should buy. One of the members voiced their opposition to the paper and print industry, specifically : MHP, PBI, and RRD. Dieing businesses versus opportunity in deaths clothing? Argument against owning looks to photo, computer hardware and the auto sectors. They correctly argue that a failure to properly evolve in a dynamic industry is terminal. The argument for owning these stocks looks to radio, entertainment,book seller/retail and printer manufacturers. All these industries were declared dead only to come back to life in re-engineered forms.

We didn't buy any of these stocks so the cowards won, I was on the contra side (ie: losing side) of the argument. Bottom line - discretion is the better part of valor.

Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.