ABB, AFL, BG, BMS, BOH, CINF, CNP, CSL, DUK, ETR, EXC, FAST, FE, FII, GXP, HAS, HD, LEG, LM, NEU, NKE, NLY, PBI, PRE, PSA, RAI, SAP, SCG, SE, SFL, SID, TEF, TOT, TX & WR

The markets are in a bit of turmoil as we did this research. Last week we did quite a few trades that were not posted. Mostly, cover for positions that had expired options. The news concerning Greece should not have been a surprise. The biggest concern we had was investor's reaction to the news. After all, Greece is less than 2.0% of the eurozone on a GDP basis. We saw the sell off as an excuse for traders to take profits or reduce exposure. Talk of a second recession has also been an issue for us.

We do not see a vibrant economy in the US. The unemployment claims appear to be skewed by the "drop off" of claimants earners who have reached the end of their ability to claim benefits. The productivity news was also an issue as has been the recent and dramatic decline in the price of oil. The latest news of the $2 billion "whale" loss at JP Morgan just shows that no matter how much oversight and regulation there is, you cannot outlaw greed and stupidity.

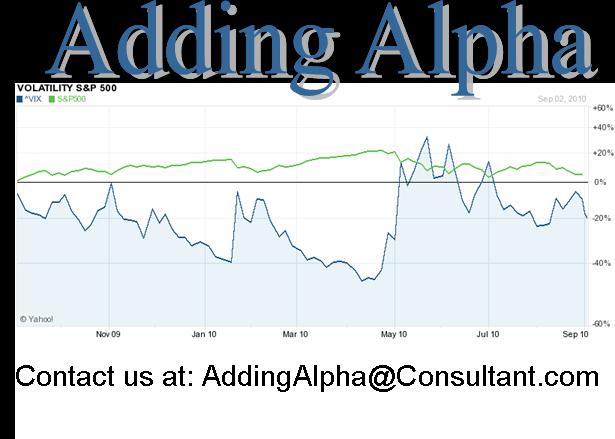

With all this said, value appears in the market for us in a number of ways. Lower stock prices and higher volatility as represented by the VIX. Both are now available and we have decided to move some money from cash to invested. Below is our current research.

Symbol Name

ABB ABB Ltd

AFL AFLAC Incorporated Common - Overall #1 - Not only do we like the stock, the goose is ok too. RVI's are at 50 and all other indicators look good.

BG Bunge Limited - Not the strongest of the group but a stock we like. The sector is a favorite and the valuations are attractive with low P/E, RVI and strong Days Earnings. Plus we have a group member who loves to say the company name.......

BMS Bemis Company, Inc - #4 overall of this group - low RVI, good P/E and paying a dividend mid month.

BOH Bank of Hawaii Corporation - thinly traded options

CINF Cincinnati Financial CORP - the stock looks attractive at first look, however, the RVI's are neat 100. the P/E's are over 30 and the options are not well traded.

CNP CenterPoint Energy Inc - #6 overall of this group and in a sector we like. RVI's are above mid but the P/E is very low and the dividend is high as are the SSR and Day's earnings.

CSL Carlisle Companies Incorporated - This stock has some attractive elements, but the RVI is too high and the dividend too low to be attractive to us.

DUK Duke Energy - The actual without dividend number is 0.13%, RVI's are neay max and the P/E is near 20. too expensive for us.

ETR Entergy Corporation - ETR is attractive on a number of levels, the P/E's are low, the RVI's are mid and the dividend is over 5%, plus it is #5 overall on this list.

EXC Exelon Corporation - Missed the dividend, overall the data look good, but the options do not offer much value.

FAST Fastenal - Attractive on a number of levels but the P/E's are nearly 25.

FE FirstEnergy Corp - RVI's are rich and P/E's are high.

FII Federated Investors, Inc - Missed the dividend. However, P/Es' are low and the RVI's are mid. The Days earning is low too as there is not too much volatility in the options pricing.

GXP Great Plains Energy Incorporated - Not too much excitement here. The valuations are ok, but with a late May dividend date of more than 4% selling the OTM call and earning a little premium and more than 1% on the dividend is not a bad thing.

HAS Hasbro, Inc - The data looks good here but just could not bring ourselves to buy the stock. Do not like the sector and the low RVI's looks to go lower.

HD Home Depot, Inc - Ranked #9 of this group. The early June payout is ok at 2.3%, however, the options pricing is attractive. RVI's and P/E's are high.

LEG Leggety & Platt Inc - RVI's are low, P/E's a bit high and dividend is paid in mid June.

LM Legg Mason - RVI's are really low as is the dividend. P/E is ok, but overall the option's volatility is high and Day's earning's are at 0.134%.

NEU NewMarket Corp - Got option's pricing? The liquidity in the traded market is just too weak.

NKE Nike, Inc - Too expensive.

NLY Annaly Capital Management, Inc - This REIT is attractive on many levels. But is is still a REIT. The big dividend is tempting as is the mid RVI. P/E's are wacky at 30 and 8, but then again it is a REIT.

PBI Pitney Bowes Inc - Personally I want to like this stock. It could not get past committee. It also paid its dividend earlier in the month.

PRE PartnerRe Ltd - Not too attractive.

PSA Public Storage - Although RVI's and P/E's are high, we like the options pricing.

RAI Reynolds American Inc - #10 of this group. We continue to like this sector and specifically RAI. Stock valuations are a bit high and the options pricing is not too aggressive. However, the fundamentals look good to us and we are not ashamed to own RAI.

SAP SAP AG ADS - #13 overall of this group. RVI's are a mid range as options volatility pricing is generous. Late May dividend with aa 0.13% Day's earning and a 1.0$ SSR - what's not to like?

SCG SCANA Corp - RVI's are around 100% and the dividend was missed, next.....

SE Spectrs Energy Corp - Missed the dividend, next .....

SFL Ship Finance International - #2 overall - RVI's are mid, P/E is low and options volatility pricing is high, there is a lot to float your boat at SFL....... ;-)

SID Companhia Sidrurgica Nacional - Pricing overall looks good but we missed the dividend, pass..

TEF Telefonica SA Common - Missed the dividend. RVI's are extremely low as is the P/E.

TOT Total S.A. - Mid June payment of nearly 6%. RVI's are low as is the P/E. Day's earning is .15 bps/day to May expri and .12 bps/day to June.

TX Ternium S.A. - #2 overall..Missed the dividend.

WR Westar Energy, Inc - Not too mush to get excited about or interested in the stock.

Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.

The markets are in a bit of turmoil as we did this research. Last week we did quite a few trades that were not posted. Mostly, cover for positions that had expired options. The news concerning Greece should not have been a surprise. The biggest concern we had was investor's reaction to the news. After all, Greece is less than 2.0% of the eurozone on a GDP basis. We saw the sell off as an excuse for traders to take profits or reduce exposure. Talk of a second recession has also been an issue for us.

We do not see a vibrant economy in the US. The unemployment claims appear to be skewed by the "drop off" of claimants earners who have reached the end of their ability to claim benefits. The productivity news was also an issue as has been the recent and dramatic decline in the price of oil. The latest news of the $2 billion "whale" loss at JP Morgan just shows that no matter how much oversight and regulation there is, you cannot outlaw greed and stupidity.

With all this said, value appears in the market for us in a number of ways. Lower stock prices and higher volatility as represented by the VIX. Both are now available and we have decided to move some money from cash to invested. Below is our current research.

Symbol Name

ABB ABB Ltd

AFL AFLAC Incorporated Common - Overall #1 - Not only do we like the stock, the goose is ok too. RVI's are at 50 and all other indicators look good.

BG Bunge Limited - Not the strongest of the group but a stock we like. The sector is a favorite and the valuations are attractive with low P/E, RVI and strong Days Earnings. Plus we have a group member who loves to say the company name.......

BMS Bemis Company, Inc - #4 overall of this group - low RVI, good P/E and paying a dividend mid month.

BOH Bank of Hawaii Corporation - thinly traded options

CINF Cincinnati Financial CORP - the stock looks attractive at first look, however, the RVI's are neat 100. the P/E's are over 30 and the options are not well traded.

CNP CenterPoint Energy Inc - #6 overall of this group and in a sector we like. RVI's are above mid but the P/E is very low and the dividend is high as are the SSR and Day's earnings.

CSL Carlisle Companies Incorporated - This stock has some attractive elements, but the RVI is too high and the dividend too low to be attractive to us.

DUK Duke Energy - The actual without dividend number is 0.13%, RVI's are neay max and the P/E is near 20. too expensive for us.

ETR Entergy Corporation - ETR is attractive on a number of levels, the P/E's are low, the RVI's are mid and the dividend is over 5%, plus it is #5 overall on this list.

EXC Exelon Corporation - Missed the dividend, overall the data look good, but the options do not offer much value.

FAST Fastenal - Attractive on a number of levels but the P/E's are nearly 25.

FE FirstEnergy Corp - RVI's are rich and P/E's are high.

FII Federated Investors, Inc - Missed the dividend. However, P/Es' are low and the RVI's are mid. The Days earning is low too as there is not too much volatility in the options pricing.

GXP Great Plains Energy Incorporated - Not too much excitement here. The valuations are ok, but with a late May dividend date of more than 4% selling the OTM call and earning a little premium and more than 1% on the dividend is not a bad thing.

HAS Hasbro, Inc - The data looks good here but just could not bring ourselves to buy the stock. Do not like the sector and the low RVI's looks to go lower.

HD Home Depot, Inc - Ranked #9 of this group. The early June payout is ok at 2.3%, however, the options pricing is attractive. RVI's and P/E's are high.

LEG Leggety & Platt Inc - RVI's are low, P/E's a bit high and dividend is paid in mid June.

LM Legg Mason - RVI's are really low as is the dividend. P/E is ok, but overall the option's volatility is high and Day's earning's are at 0.134%.

NEU NewMarket Corp - Got option's pricing? The liquidity in the traded market is just too weak.

NKE Nike, Inc - Too expensive.

NLY Annaly Capital Management, Inc - This REIT is attractive on many levels. But is is still a REIT. The big dividend is tempting as is the mid RVI. P/E's are wacky at 30 and 8, but then again it is a REIT.

PBI Pitney Bowes Inc - Personally I want to like this stock. It could not get past committee. It also paid its dividend earlier in the month.

PRE PartnerRe Ltd - Not too attractive.

PSA Public Storage - Although RVI's and P/E's are high, we like the options pricing.

RAI Reynolds American Inc - #10 of this group. We continue to like this sector and specifically RAI. Stock valuations are a bit high and the options pricing is not too aggressive. However, the fundamentals look good to us and we are not ashamed to own RAI.

SAP SAP AG ADS - #13 overall of this group. RVI's are a mid range as options volatility pricing is generous. Late May dividend with aa 0.13% Day's earning and a 1.0$ SSR - what's not to like?

SCG SCANA Corp - RVI's are around 100% and the dividend was missed, next.....

SE Spectrs Energy Corp - Missed the dividend, next .....

SFL Ship Finance International - #2 overall - RVI's are mid, P/E is low and options volatility pricing is high, there is a lot to float your boat at SFL....... ;-)

SID Companhia Sidrurgica Nacional - Pricing overall looks good but we missed the dividend, pass..

TEF Telefonica SA Common - Missed the dividend. RVI's are extremely low as is the P/E.

TOT Total S.A. - Mid June payment of nearly 6%. RVI's are low as is the P/E. Day's earning is .15 bps/day to May expri and .12 bps/day to June.

TX Ternium S.A. - #2 overall..Missed the dividend.

WR Westar Energy, Inc - Not too mush to get excited about or interested in the stock.

Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.