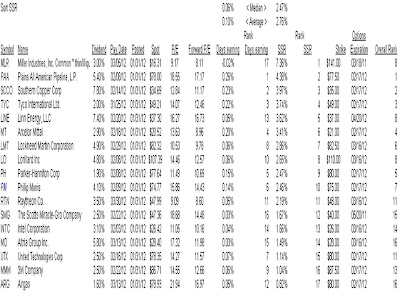

01/31/12 ARG, INTC, LINE, LMT, LO, MLR, MMM, MO, MT, PAA, PH, PM, RTN, SCCO, SMG, TYC & UTX

This analysis was performed based on close of market pricing for January 31, 2012

The close for the S&P 500 1,312.41

The close for the VIX 19.40

ARG Airgas - P/E's are high as RVI's. Like the sector but this stock is not offering much in this analysis.

INTC Intel Corporation - Not sure where the volatility went with this one. RVI's are high as the dividend. Don't like the scenarios we are showing. Repricing it with the market open I do like the Feb 27's with spot at $26.72.

LINE Linn Energy, LLC - Nice dividend and mid RVI's. The options do not offer much, but do enhance the return. Sell ATM's and look to roll into March OTM's if possible to capture div.

LMT Lockheed Martin Corporation - High RVIs' and low P/E's. If we took a position with would be the Feb scenario.

LO Lorillard Inc - RVIs' mid 70's, good P/E's. Would stick to Feb 110's.

MLR Miller Industries, Inc. Common * thin/illiquid options - we need to eliminate this from our database. The options pricing/market is at best weak for MLR.

MMM 3M Company - RVI's in mid 60's, low P/E's. Sell Feb just ATM or OTM's and roll into March to capture the dividend.

MO Altria Group Inc. - RVI's are mid high, March div, would sell Feb ATM and roll into the March Div.

MT Arcelor Mittal - ranked #4 overall of this group - RVI's are low as are the P/E's. Div pay date is off on our analysis, it should be May payment not Feb.

PAA Plains All American Pipeline, L.P. -Ranked #1 overall in this group - a 5.4% dividend with an 18.6 P/E, RVI's are at the top, div date looks to be before Feb expri, would look to sell March at or above market strike

PH Parker-Hannifon Corp - Mid RVI's and low P/E's. The dividend is ok but pays in Feb. Sell the Feb 80's.

PM Phillip Morris - RVI's are mid high, Feb div, would sell March OTM's/$75..

RTN Raytheon Co. - RVI's are mid 60's and P/E's are low. Look to sell just OTM's in March.

SCCO Southern Copper Corp - #2 ranked overall stock of this group - Mid-range RVI's, low P/E's, nice dividend.

SMG The Scotts Miracle-Gro Company - RVI's are low to mid, SSR is ok. Would sell March just OTM's/50's.

TYC Tyco International Ltd.- Ranked #3 overall of this group - Mid high RVI's, P/E's are good

UTX United Technologies Corp - mid placed in this group but it has mid RVI's and low P/E.s The overall profile is attractive. We would sell March 80's.

Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.