UPDATE Not really sure why I have not been able to get all the individual stock data loaned. I know it has to do with a revised method of uploading the information. I seem to be struggling as a blog/web master and for that I apologize..:

However, I am excited about some of the stocks and their ranking.

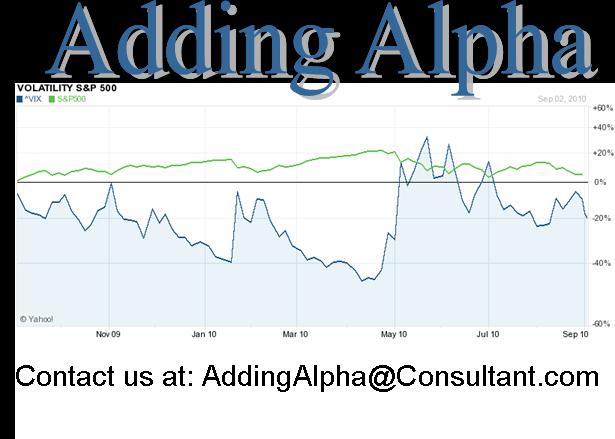

For those of you who follow volatility, it is on the rise and that is helpful.

Of the stocks listed most of the top listed stocks on the ranking sheets (those other than the Alpha Sort) are quality investments and they have strong valuation as buy/writes.

Let me know via messaging if you need anything that has not posted.

For the week ending Thanksgiving we present our most recent analysis

:

List of this weeks current analysis in alphabetic order, reports below:

| Symbol | Name | Dividend | Pay Date |

| ADI | Analog Devices, Inc | 2.70% | 11/28/13 |

| ADP | Automatic Data Processing, Inc. | 2.40% | 12/11/13 |

| AEE | Ameren Corporation | 4.40% | 12/09/13 |

| AEO | American Eagle Outfitters, Inc | 3.10% | 12/30/13 |

| AGU | Agrium, Inc | 3.40% | 12/26/13 |

| ALB | Albemarie Corporation | 1.40% | 12/11/13 |

| APD | Air Products & Chemicals Inc. | 2.60% | 12/30/13 |

| ARG | Airgas | 1.70% | 12/10/13 |

| AUY | Yamana Gold | 2.90% | 12/27/13 |

| AXS | Axis Holdings Limited | 2.00% | 12/27/13 |

| BANF | BancFirst Corporation – no options | 2.20% | 12/26/13 |

| BAX | Baxter International Inc | 2.09% | 12/04/13 |

| BDX | Becton, Dickinson and Company | 1.80% | 12/05/13 |

| BEN | Franklin Resources, Inc | 0.70% | 12/26/13 |

| BXS | BancorpSouth, Inc | 0.80% | 12/11/13 |

| CAH | Cardinal Health, Inc | 1.90% | 12/30/13 |

| CB | The Chubb Corporation | 1.80% | 12/19/12 |

| CBU | Community Bank System, Inc | 4.00% | 12/18/13 |

| CCJ | Cameco Corporation Common | 1.90% | 12/26/13 |

| CIM | Chimera Investment Group | 12.00% | 12/31/13 |

| CNI | Canadian National Railway Company | 0.70% | 12/06/13 |

| EAT | Brinker International, Inc. | 2.00% | 12/04/13 |

| ECL | Ecolab Inc | 0.90% | 12/13/13 |

| EIX | Edison International | 2.90% | 12/26/13 |

| FGP | Ferrellgas Partners LP | 8.40% | 12/04/13 |

| FTR | Frontier Communications Co | 8.50% | 12/05/13 |

| GPC | Genuine Parts Company | 2.60% | 12/04/13 |

| HI | Hillenbrand Inc Common Stock | 2.70% | 12/12/13 |

| HPQ | Hewlett-Packard Company | 2.30% | 12/09/13 |

| HRB | H&R Block, Inc. | 2.80% | 12/05/13 |

| KMB | Kimberly-Clark Corp Common | 3.00% | 12/04/13 |

| KO | The Coca-Cola Company Common | 2.80% | 11/27/13 |

| LEG | Leggety & Platt Inc | 4.00% | 12/11/13 |

| MKC | McCormick & Company | 2.00% | 01/03/14 |

| MLR | Miller Industries, Inc. Common * thin/illiquid options | 3.00% | 12/05/13 |

| MO | Altria Group Inc. | 5.20% | 12/12/13 |

| MOS | Mosaic Company | 2.10% | 12/03/13 |

| MRK | Merck & Co, Inc | 3.50% | 12/12/13 |

| NUE | Nuroc Corporation | 3.90% | 09/28/11 |

| RAI | Reynolds American Inc | 5.00% | 12/06/13 |

| RBC | Regal-Beloit Corporation | 1.10% | 12/24/13 |

| RCI | Rogers Communicatoins, Inc | 3.70% | 12/11/13 |

| SCG | SCANA Corp | 4.30% | 12/06/13 |

| SDRL | Seadrill Limited ORD | 8.00% | 12/05/13 |

| STLD | Steel Dynamics | 2.40% | 12/26/13 |

| SYK | Stryker Corporation Common | 1.40% | 12/26/13 |

| TM | Toyota Motor Corp. | 2.00% | 12/26/13 |

| VAL | The Valspar Corporation | 1.40% | 11/27/13 |

| WMT | Wal-Mart Stores, Inc | 2.30% | 12/04/13 |

| WOR | Worthington Industries, Inc | 1.50% | 12/11/13 |