AA, ABB, ADP, APD, APL, BHP, CAG, CAT, CF, CLX, COP, CPO, CTL, CVX, D, DBD, DCI, DE, EAT, ETN, INTC, JNJ, POT, RAI, RRD, SCCO, TAP & UVV

So the question is how did we fare in last weeks rally?

We re-analyzed about 1/3 of last weeks stocks for today.

Only two stocks had a negative return, CTL and UVV. CTL paid a dividend right after the analysis. The issues weighing on UVV's are a little less clear.

Keep in mind that when a stock "falls" from the top, the typical reason is that it has out performed. We did have to adjust strike prices higher on some of the names.

Symbol Name

AA Alcoa Inc - remains within the overall top 5 of both weeks lists. RVI's are below 20 and the Days Earning are huge.

ABB ABB Ltd - fell toward the mid in the current list - RVI's are below 30 and the Days Earning are above 10 bps/day.

ADP Automatic Data Processing, Inc. - RVI's have moved up and the stock has fallen toward to bottom of the group.

APD Air Products & Chemicals Inc. - Remains in the top 6, RVI's are below mid with the Call at 57%. Near date Days Earning are at 30bps/day.

APL Atlas Pipeline Partners LP - remains in the mid of the group. RVI's are high with all three value around 80%.

BHP BHP Biliton Limited - Remains near the top. No surprise given the questions around precious metals and inflation. The stock is volatile and RVI's remain low in the 30's.

CAG ConAgra Foods, Inc - #1 overall in this group. Considering the issues related to crops and forecasting no wonder! RVI's are fair valued and Day's earning are very high.

CAT Caterpillar Inc. - RVI's around 60% are mid-high while Days earning are 18bps/day at the near date.

CF CF Industries Holdings, Inc - #2 overall and just as high last week. RVI's are 30-40% and Days earning are 31bps. We like this sector and stock but understand the issues related to crops is a problem. P/E's are low but caution is warranted.

CLX The Clorox Company - Low RVI's and high P/E's. The stock is offering a SSR of 1.4% for 12 days. Suprising.

COP ConocoPhillips - Our analysts priced this one wrong so we will pass on it until we get better data.

CPO Corn Products International Inc. - So much for unknown and counting issues. The RVI's are 60-80% with low P/E's and Days earning at 11 bps/day. CAG and COP have performed about the same over the past year, but CAG represents the more attractive buy of the two at this point.

CTL CenturyLink, Inc - Low RVI's and P/E's. Days earning at 13bpd/day.

CVX Chevron Corp. - High RVI's and low P/E. Days earning is below 10bps/day. Not too much to offer in this environment.

D Dominion Resources, Inc - High RVI's mid P/E's and not very exciting overall.

DBD Diebold, Inc - Another stock that is tough to quantify. It is at the bottom of the group and the numbers are not too compelling.

DCI Donaldson Company, Inc. - upper end of the group but RVI's are at the top end, P/E's are high. The earning profile is not compelling for the apparent risk.

DE Deere & Company - RVI's are mid range, P/E's are low and Days earning is at 20 bps/day. Dividend date is at the end of Dec, so take the early date and roll into Jan.

EAT Brinker International, Inc. - mid0high RVI's but a near ex date and low P/E's. Would be nice if there were 24 strikes to sell. The 25's are the best going so sell the near date and capture the dividend along with the 1.5% SSR should earn about over 2%.

ETN Eaton Corporation - RVI's are mid, P/E's are low and the Days earning is at 23bps/day. ETN is high on the list and very attractive.

INTC Intel Corporation - High RVI's, low P/E's and Days earning just above 10 bps/day. We like the stock for a long term play understanding the volatility.

JNJ Johnson & Johnson - 2nd from the bottom of the group. How many ways can we say boring. RVI's are mid range, P/E's are good and the return profile is not very exciting. The Price range is just over $10 and the stock is mid range. Not very exciting, nut the call suggested is in the money.

POT Potash Corporation of Saskatchewan, Inc - #6 overall on this list. Much smaller CF has out performed POT for most periods except the past week. POT's data looks good with low RVI's and P/E's. Days earning is at 25 bps/day near and 11 bps/day just past the expected ex-date.

RAI Reynolds American Inc - Top end RVI's with an ex date this week. Days earning is near 20 bps/day and the call is in the money. We like this stock and the trade looks compelling if you do not mind being called.

RRD RR Donnelley & Sons Co - Low RVI's and P/E's. Days earning is over 20 bps/day.

SCCO Southern Copper Corp - Low RVI's and P/E's. Days earning is over 20 bps/day. How is it everybody is stealing copper and these guys can not get their stock to rally?

TAP Molson Coors Brewing Company - Low RVI's and P/E's. Days earning is under 20 bps/day (10 bps). Not as exciting as the rest of the group but remember this is beer.

UVV Universal Corp Common - just over mid RVI's low P/E and a 4.5% div paying early Jan. Take the Jan trade and enjoy New Years!

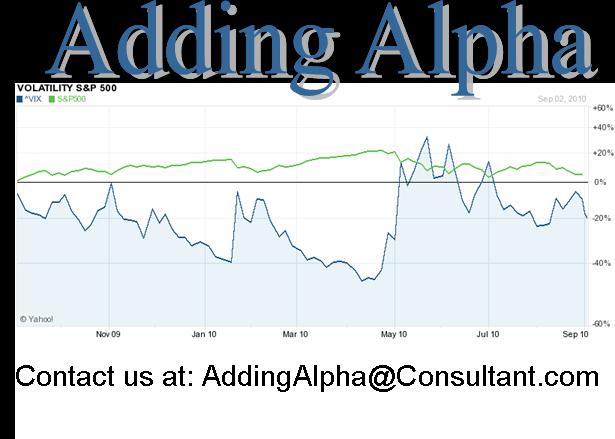

The VIX was at 27.52 when we priced these trades.

Last week it was at 34.5 or 25% higher.

The S&P has increased 86 points or 7.4%

Needless to say the movements are not symmetric. Not surprising as risk is priced differently than the market. What does surprise us is that the World seems to be less safe today for investors than it was last week. Europe is more of a mess, the US is hopeless and Asia is in a funk. Granted we are approaching year end and portfolio managers may have panicked fearing an inability to gain window dressing at good prices. Most of the trades prices are compelling in their spot metrics. We like to believe compelling trades call out and most of the above with Days earning to the near date around 20 bps/day are screaming out "buy me"! This supports our near dated bias in these uncertain and volatile markets. Granted the JNJ's and CLX's look boring but maybe boring is the safest place for now.

Best wishes and happy investing.

As always we are willing to run your personal trade ideas through our model as long as our resources are available. You can contact us at Addingalpha@consultant.com

Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.