This group of stocks were in an article in the site SeekingAlpha.comin an article entitled, "24 Best Dividend Stocks with Growing Yields", written by, Insider Monkey.

Symbol Name

ABT Abbott Laboratories - #2 in overall profile for this group - RVI's are just off mid range - each scenario earns the dividend, near date Days Earning are 12 bps a day! We have and continue to like ABT.

ADP Automatic Data Processing, Inc. - We chose the May 50's, RVI's are at the top end. We like the business model and have been in and out of this stock for a while. Basically it is a solid earning stock in annuity businesses. The P/E, spot and forward, are at the high end and we would begin to exercise caution until premiums increase. Ownership will be predicated on strong fundamentals.

APD Air Products & Chemicals Inc. - Another stock we have liked and we highlighted this sector previously - RVI's are high and the Days earning for the near date is 8 bps. We continue to like the fundamentals of this sector and like the stock as a core holding pricing strikes close to spot.

BMS Bemis Company, Inc - Within this group the buy/write profile is not very attractive - each scenario earns the dividend, RVI's are at the top end, the Days earning and SSR's are low. Ownership will be predicated on strong fundamentals.

CB The Chubb Corporation - Another weak buy/write profile - we remain cautious on financial and insurance stocks. Fundamentals will drive their prices and their portfolios remain suspect to us. Pricing power for their products will be weak for all sectors.

CINF Cincinnati Financial CORP - #24 of the 24 stocks reviewed - The Buy/Write is not attractive, this has been the case for the stock over the past year. The dividend is very attractive and based on the very high RVI's the stock has performed well. Ownership will be predicated on strong fundamentals.

CLX The Clorox Company - RVI's are high, but the dividend is attractive. CLX is in a sector we like. Near date and far date Days Earning are impacted by the dividend. The adjusted difference is 3.3 bps a day. This is significant enough to make us want to sell the near date and "roll" the position (re-establish) mid April.

CTAS Cintas Corporation - Another company in a business we like that provides limited Buy/Write rewards. The RVI's are very high indicating rewarding stock performance, albeit within a narrow range. 7-5 bps a day is attractive for this stock and we would establish for the near date and continue to profit from call writing.

CTL CenturyLink, Inc - #3 overall for this group - NOTE MAY EXPRI - no surprise here, the sector is experiencing a lot of attention with M & A activity. P/E's are low, RVI's are high, we would take position in the near date expecting to get called.

ED Consolidated Edison, Inc - Stodgy old utility? #1 overall of this group - we featured domestic utility stocks in a recent post - The RVI's are very high, however the P/E, dividend are attractive. We are keeping the stock on a tight leash with an in the money near date buy/write being the most attractive.

EMR Emerson Electric Co. - #5 overall of this group - P/E's are ok to good, RVI's are mid high and the dividend pays early May.

JNJ Johnson & Johnson - Last of this group - Why? This is a greater mystery - Understanding the issues related to their star product Tylenol, volatility should be way high! - Needless to say, RVI's are low - Trade the rumor sell the fact - Buy/Writes are not attractive for a stock that we like fundamentally and are searching for reasons to justify its position. JNJ have always rebounded from their head ach's............

KMB Kimberly-Clark Corp Common - Again, another stock where we like the sector but the Buy/Writes are not very attractive. P/E's are attractive as is the dividend. RVI's are high to extreme. Days earning and SSR's are small. This is another company that you need to justify owning based on fundamentals.

KO The Coca-Cola Company Common - Unlike their competitor, if there is such a thing, KO's stock has performed well as evidence by the extreme RVI's. Again like a lot of stocks in sectors we like, KO has rewarded and is not offering much for Buy/Writes.

LEG Leggety & Platt Inc - #8 overall in a competitive group - RVI's are at the high end and P/E's are as well. May 25's offer some upside and 5 bps a day.

MCD McDonald's Corp - another favorite that is tough to justify buying based on Buy/Write's. RVIs are high mid and the dividend is nice. It is that volatility does not appear to be high enough. This is another company that you need to justify owning based on fundamentals.

MHP The McGraw-Hill Companies, Inc. - New to us, #4 of ths group - 10 bps a day to the near date and 7 to the next closest expri. RVI's are high.

MMM 3M Company - A long time favorite going back to grad school. RVI's are very high, and the opportunity seems to be in May 90's that are in the money. We continue to like the sector and see 5 pbs a day as ok. P/E's are low and it is just difficult to find a cheap/attractive stock in this sector with compelling Buy/Writes.

PBI Pitney Bowes Inc - #5 of this group - we have liked PBI for several quarters, but at the RVI's indicate it has performed well. This is another company that you need to justify owning based on fundamentals.

PEP Pepsico, Inc - RVI's mid, P/E good, RVI's 6 bps a day. The overall profile based on Buy/Writes and our criteria are twice as attractive as KO, assuming KO is your benchmark.

PG The Procter & Gamble Company - this is one of our Bedrock Stocks and we like it - RVI's are high, P/E's are low. The dividend is paid next month and is attractive.

PPG PPG Industries, Inc - RVI's are very high and the P/Es are creeping upward. We like this sector and this stock.

VFC V.F. Corporation - this stock is new to us - Top end RVI's, ok P/E's. The Days earning and SSR's are attractive. We need to do some fundamental work to justify a position.

WMT Wal-Mart Stores, Inc - Mid RVI's (not something we write often lately), Low P/E's. WMT's problems are well known but we would still continue to own the stock.

This analysis was performed at the market close of March 30, 2011.

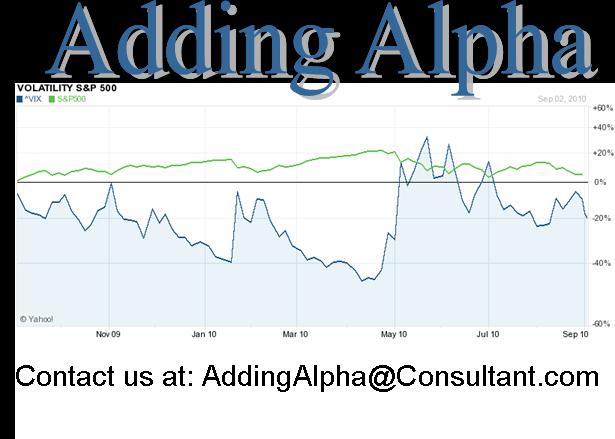

The VIX closed at 17.71.

The S&P 500 closed at 1,328.26.

*Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.

As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.