For an explanation of how to reas and use the analysis pages below see the Page: "How do I understand the Analysis? Keys to understanding and reading the analysis!" - The page is located under the banner "PAGES" on the left hand column.

This analysis was performed after the market close of January 26, 2011.

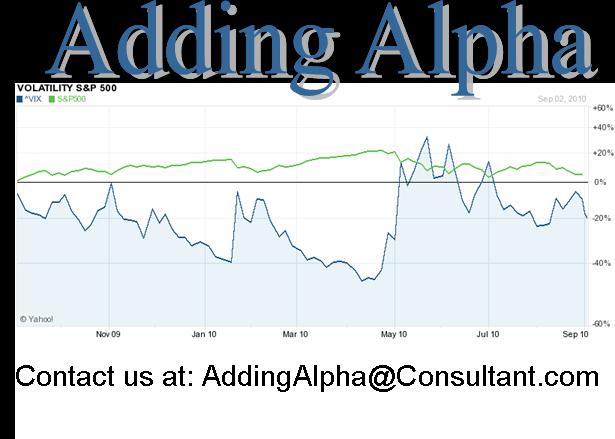

The VIX closed at 16.84

The S&P 500 closed at 1,297.51

* COMMENTARY TO FOLLOW

Symbol Name

AEP American Electric Power

APL Atlas Pipeline Partners LP

BXS BancorpSouth, Inc

CAG ConAgra Foods, Inc

CMS CMS Energy

CTL CenturyLink, Inc

DUK Duke Energy

ED Consolidated Edison, Inc

EPB El Paso Pipeline Partners, LP

FTR Frontier Communications Co

HEP Holly Energy Partners, LP

KMP Kinder Morgan Pipeline

LEG Leggety & Platt Inc

LLY Eli Lilly and Co

LMT Lockheed Martin Corporation

MO Altria Group Inc.

MRK Merk & Co, Inc

PAYX Paychex, Inc.

PBI Pitney Bowes Inc

PGN Progress Energy Inc

POM Pepco Holdings Inc

Q Quest Communications International Inc

RAI Reynolds American Inc

RRD RR Donnelley & Sons Co

SFL Ship Finance International

TEG Integrys Energy Group, Inc

UVV Universal Corp Common

VZ Verizon Communications Inc

WIN Windstream Corp

*Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.

As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.