The VIX declined steadily throughout the day closing down 4.44% from 18347 to 17.65.

The S&P 500 was up 0.6% for the day closing at 1,291.

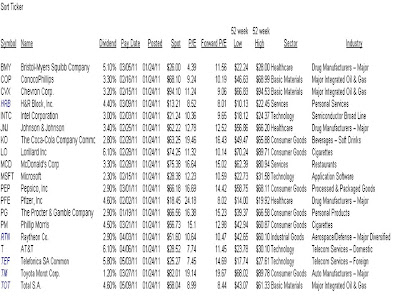

The stocks were reviewed by presented in an article written by Nicholas Southwick Levis published on January 23, 2011, at SeekingAlpha.com entitled, "20 Relatively Safe and Cheap Dividend Stocks for Income Investors".

Ashford Hospitality Trust, a REIT was not included in our analysis as there are is no declared dividend, P/E's or other matrix we like to look readily available. Furthermore, we really do not care for REITS and are very picky about the ones we will own. This particular REIT appears to be dominated by hospitality, a sector we do not really like in this current economic environment.

LO is a stock that was much discussed in the comments section of the article. We like the profile of the stock and we like the sector as well.

We provided the #1-3 ranking of the group for SSR, Days Earnings and Overall combination. HRB,

Symbol Name

BMY Bristol-Myers Squibb Company - Overall #2 tied/SSR #1 - The dividend impact is huge as the dividend at 5.1%. The RVI's are just above mid range. There is a lot to like about this stock based on its statistical profile.

COP ConocoPhillips - Overall #2 tied/Days Earnings #2 - RVI's are at the top of the range, that is the bad news. Each scenario earns the dividend. We like this sector.

CVX Chevron Corp. - Like COP RVI's are at the top of the range, each scenario earns the dividend and we like the sector.

HRB H&R Block, Inc. - (NEW) - Overall #1/Days Earnings #1 - This is our first look at this stock. The volatility's pricing is strong at the near dates especially into the dividend. RVI's are low and the stock has been on a major down trend. It is off its October low of $10/ and the near term trend and sentiment is positive, we suggest you do your research extra careful with this stock.

INTC Intel Corporation - We have been big fans of Intel for a long time as far as our strategy goes. RVI's are mid range and each scenario earns the dividend.

JNJ Johnson & Johnson - Another stock we like in a sector we like. The overall profile is nothing to make a fuss over, but JNJ is a Bedrock stock.

KO The Coca-Cola Company Common - RVI's are high and the dividend is paid in the later dates.

LO Lorillard Inc - Days Earning #3 - RVI's are low and the stock has been hammered as a response to their recent acquisition. We like the sector but are not crazy about diversification efforts. Their purchases are ok, but we have seen too many "sin" companies diversify with poor results outside their core business.

MCD McDonald's Corp - RVI's are high but not outrageous. We like MCD and believe it is a well run company. The dividend makes the far date attractive.

MSFT Microsoft - RVI's are high mid range. It is hard not to like MSFT and we have been active in the stock for quite a while.

PEP Pepsico, Inc SSR #3 - RVI's are high, across the board each date pays around 0.02%/day.

PFE Pfizer, Inc - As noted the difference between the $18 and $19 strikes was a few pennies. We chose to use the $18 in the money's in our analysis thus eliminating the upside/stock appreciation. RVI's are high.

PG The Procter & Gamble Company - Another company we like for many reasons and a Bedrock stock. RVI's are at and above 100%.

PM Phillip Morris SSR #2 - Unlike it's competitor LO, it has gained in value and has high RVI's. We have liked the stock for a long time and continue to like it.

RTN Raytheon Co. (NEW) - Despite the fact they make really neat things, RVI's are low, the sector is strong and the stock has a nice return profile.

T AT&T - RVI's are high, however we have and continue to like this stock in this sector. As noted the $28 strike calls provided a few more pennies in income than the $29 strike. We chose to sell the "in the money" calls.

TEF Telefonica SA Common (NEW) - RVI's are high, the rest of the profile is ok.

TM Toyota Motor Corp. (NEW) - RVI's are mid range and the overall profile is not too exciting.

TOT Total S.A. (NEW)- RVI's are very high and the overall profile is not too exciting for a sector we like.

*Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.

As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.

No comments:

Post a Comment