NOTE: The original posting was released early to facilitate the sharing of some of the charts with a client. I have completed the posting and included additional observations on the market. Basically, I believe there is value in the equity market based on the date I present below.

Some of the value is in the supply/demand function, other is relayed in risk premium.

The equity markets receive automatic investments based on superannuation plan investment, reinvestment and asset allocation schemes. This is not an insignificant number. It is one I have calculated in the past but currently do not have the time or resources at hand to calculate. Secondly, the risks in the fined interest markets are astronomical. The value of a basis point is about the highest it has ever been. Each sell off costs debt holders more than ever before. Credit is deteriorating and cash is a being horded. If the US Fed abandons its buy back programs you can be assured yields will rise, eventually. The BoJ buy back kept yields low and my guess is that the Fed is aware of the catastrophic impact of artificially supporting a market against the will of investors. Certainly this is the playground of Schwartz György (aka George Soros) and his type, I prefer investing over gambling and speculating. The each their own.

Nonsense

I have been looking for the answer to the divergence risk to equity market movements. Readers will remember how much we look at the VIX and value it as a took to manage risk and an indicator of investor pricing of risk. However, the VIX has been declining for quite a while.

30 day VIX graph

90 day VIX graph

Note the "Fiscal Cliff" spike at the end of December and subsequent collapse or the index that represents risk.

1,825 day/5 year VIX graph

The above 5 year graph shows a pattern of lower highs and stable lows until this months collapse. Seems like a technical traders dream.

So I downloaded some data and took a closer look at it.

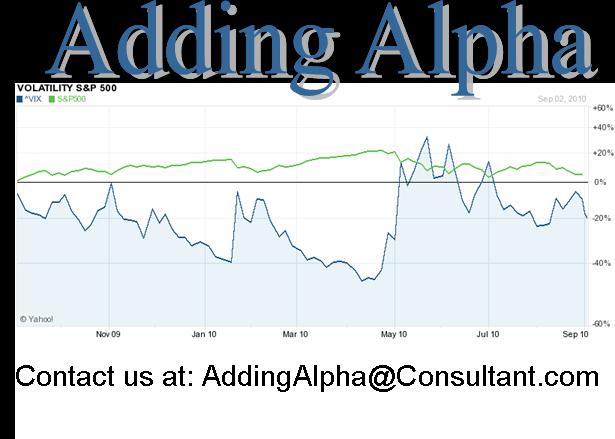

The above chart is the closing price of the S&P 500 charted against the closing price of the VIX for the past 5 years. The correlation coefficient for this period is -74, not an insignificant number. The inference I took from this was that as the market moved, the risk premium followed in the opposite direction. There did not appear to be any indication of one data set leading the other.

The S&P is up for the past few weeks - want to know why.... read on:

The S&P is up for the past several years - want to know why.... read on:

I do not remember what this chart represents but it is darn impressive.

Perhaps it is the VIX?

Despite turmoil and the Fiscal Cliff the S&P is up..... want to know why? Read on....

WOW the reason appears to be related to the above two charts - well at least in part to this date.

Savings and corporate cash retention are up whole consumption and corporate spending is down.

Any way you look at it, those with cash are hording. They are not spending and my guess is that they are investing their money in the market. Why take risks in a uncertain environment when you can place your bets on the existing companies who already exist?

This is one clear indication of uncertainty. When people with money feel uncertain they hold their cards close and limit their bets. ie: they don't take risk and rely on others to keep things going, ie: they don't spend and invest that money in proven winners.

Some of the value is in the supply/demand function, other is relayed in risk premium.

The equity markets receive automatic investments based on superannuation plan investment, reinvestment and asset allocation schemes. This is not an insignificant number. It is one I have calculated in the past but currently do not have the time or resources at hand to calculate. Secondly, the risks in the fined interest markets are astronomical. The value of a basis point is about the highest it has ever been. Each sell off costs debt holders more than ever before. Credit is deteriorating and cash is a being horded. If the US Fed abandons its buy back programs you can be assured yields will rise, eventually. The BoJ buy back kept yields low and my guess is that the Fed is aware of the catastrophic impact of artificially supporting a market against the will of investors. Certainly this is the playground of Schwartz György (aka George Soros) and his type, I prefer investing over gambling and speculating. The each their own.

Nonsense

I have been looking for the answer to the divergence risk to equity market movements. Readers will remember how much we look at the VIX and value it as a took to manage risk and an indicator of investor pricing of risk. However, the VIX has been declining for quite a while.

30 day VIX graph

90 day VIX graph

Note the "Fiscal Cliff" spike at the end of December and subsequent collapse or the index that represents risk.

1,825 day/5 year VIX graph

The above 5 year graph shows a pattern of lower highs and stable lows until this months collapse. Seems like a technical traders dream.

So I downloaded some data and took a closer look at it.

The above chart is the closing price of the S&P 500 charted against the closing price of the VIX for the past 5 years. The correlation coefficient for this period is -74, not an insignificant number. The inference I took from this was that as the market moved, the risk premium followed in the opposite direction. There did not appear to be any indication of one data set leading the other.

The S&P is up for the past few weeks - want to know why.... read on:

The S&P is up for the past several years - want to know why.... read on:

I do not remember what this chart represents but it is darn impressive.

Perhaps it is the VIX?

Despite turmoil and the Fiscal Cliff the S&P is up..... want to know why? Read on....

Savings and corporate cash retention are up whole consumption and corporate spending is down.

Any way you look at it, those with cash are hording. They are not spending and my guess is that they are investing their money in the market. Why take risks in a uncertain environment when you can place your bets on the existing companies who already exist?

This is one clear indication of uncertainty. When people with money feel uncertain they hold their cards close and limit their bets. ie: they don't take risk and rely on others to keep things going, ie: they don't spend and invest that money in proven winners.