ADP, AEE, AEO, AGU, APD, ARG, BXS, CAG, CAH, CB, CBU, CIM, CTL, DE, ECL, EIX, FITB, FNF, FRT, GES, HI, HNZ, HPQ

The focus of this and the next few posts will be attempts to gain dividend income before the new year. The stocks below are just those from A-H that pay dividends from 12/04 to 12/31.

ADP - We like this stock and their business model. RVI's are 60-70 but with the near term SSR's so low .35 and .97% the reward is low.

AEE - Very low RVI's is the best comment we have

AEO - Ranked #1 overall - SSR ranked #3 - #4 days earnings - AEO and GES are the two pure retailers in this group. We like both of these stocks. AEO is rich on a RVI and most other indicator basis.

AGU - Ranked #2 overall - #1 days earnings - Overall profile is good but RVI's are in the 80+ range indicating the high end of the price range.

APD - We like this stock. However, the rewards are low but the RVI's are also low.

ARG - Ranked # 5 overall - #5 days earnings - We like this stock a lot and the RVI's are mid range while the days earnings and SSR provide good reward.

BXS - The low rewards do not justify the risk of a buy/write basis.

CAG - We like this stock and sector. SSR's are attractive but the stock is at the 90-100 RVI range of price.

CAH - Not much to like on an analytic basis.

CB - OK profile - fundamentals should be looked at carefully with all the storm related P&C risks lurking out there in the world.

CBU - Analytic profile is a mess, perhaps a data error, the buy/write rewards are not attractive.

CIM - SSR ranked #1 - Real Estate REIT so the options are not well priced. The dividend looks great at 13.1% - did I mention this is a REIT?

CTL - #3 days earnings - We like the profile of CTL. The rewards are rich and the RVI's are mid range.

DE - this has been one of our favorite stocks and sectors in this economy. The RVI's are mid high and the stock has done well. Not so attractive on a analytic basis but fundamentally may be worth owning.

ECL - At 100 on a RVI basis and not much reward elsewhere.

EIX - Doesn't offer much on an analytic basis.

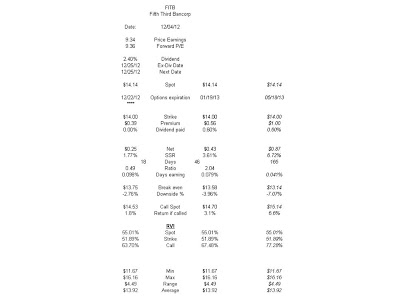

FITB - Ranked #3 overall - #4 SSR - However, the data inputs are suspect and the options market is not what the pricing makes it appear to be.

FNF -

FRT - MISTAKE - ignore this one it has too many data errors to be correct.

GES #2 days earnings - Like AEO we like this stock. The Dec option rewards well and the RVI's are very low.

HI Ranked #4 overall - #5 SSR - This is a stock we like and a sector we like. The rewards however are low for the buy/write strategies.

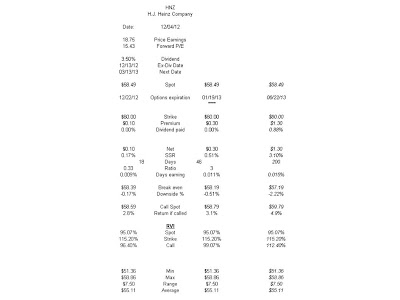

HNZ - the analytic profile is attractive. However, the RVI's are 95-115.

HPQ - SSR ranked #2 - MISTAKE - too many data input errors to be correct. Also based on the management and operating problems in the company we would not be likely to buy HPQ until there is some resolution to these matters.

Note: the tables shown are embedded .jpg files. This means that you can: 1) double left click them with your mouse to enlarge them, or 2) right click them with your mouse and choose to open them in a new window or tab, print, save, etc.As with everything we post, we may or may not have the stock and/or strategy in place in any one of our portfolios or may add it at any time. We do not make any buy or sell recommendations. We provide basic analytical research, some short commentary of the results and encourage you to do your own thorough due diligence prior to any purchase or sale.

No comments:

Post a Comment